Success Story: How We Saved Owners Thousands Of Dollars Of Interest

01.10.24

In 2019 we assisted a development of 33 owners to change from a large strata management company based in Port Melbourne. As part of our onboarding process we review the financial statements and bank statements in great detail. We were shocked to find the owners corporation manager provided a loan of $20,000 and had charged an interest rate of 17%, as well as loan administration fees charged annually.

This loan, and its accompanying additional fees, interest rates and charges, were not disclosed to the owners corporation or the committee at any point in time. Compounding this issue, the strata manager failed to set adequate budget that successfully met the cashflow requirements of the owners corporation for any particular year. The manager continued to rely on the undisclosed loan rather than having the honest conversation with owners about how regular and ongoing expenses were being paid.

When Resi was appointed the new owners corporation manager, the strata company attempted to claim they were entitled to reimbursement for the total loan amount. They claimed that the loan was provided by Macquarie Bank, but couldn’t provide any proof or official documents from Macquarie Bank that this was a legitimate bank loan.

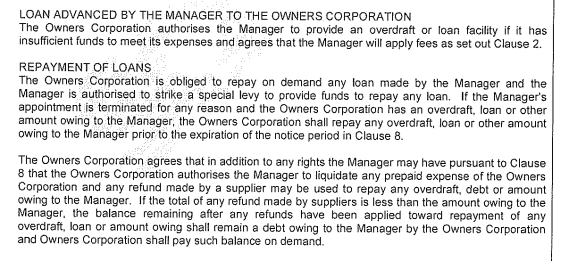

The manager tried to claim that the contract of appointment entitled them to a refund of the loan, however a contract of appointment isn’t a ‘carte blanche’ to allow the manager to do literally whatever they want.

A body corporate manager is akin to an intermediary or an agent where they carry out the instructions of the owners corporation. A manager cannot rely on a clause in a contract (especially one that is over 20 pages long) to circumvent their obligations to seek approval for matters, especially those that will cost owners thousands of dollars in additional fees and charges.

Close reading of the contract of appointment indicates that the loan was provided by the management company, which is a clear conflict of interest! An owner corporation manager has the duty to act in the best interest of the owners corporation, but in this instance failed to propose adequate budgets that covered the regular and ongoing expenses; why have difficult conversations with owners when you could just ignore the problems and also get more fees at the same time?

If your manager provides you with the option of obtaining a loan to pay for expenses, it’s important to find out the following:

- Who is providing this loan (a formal lending company, a bank, the management company themselves)?

- What is the interest rate and are there any associated fees?

- What are the terms and conditions of this loan? A legitimate loan will always have separate documents and contracts

- What clauses are in the management contract that relate to this loan? Are there any agreements between the lender and the strata manager? Does the manager receive any commissions or incentives for taking out the loan?

With the increasing cost of construction and ongoing repairs that are required, there are always circumstances when there is a genuine need for a loan. There are specialist finance companies that specialise in the provision of loans to owners corporations to help avoid any conflicts of interest.