How The Recent Troubles In The Construction Industry Are Affecting Your Body Corporate Fees

28.06.22

It’s almost a daily basis now there’s an article in the news about another construction company going out of business. The issues facing the construction industry have long-reaching consequences, and unfortunately townhouse owners corporations are being adversely affected by it.

The Cost For Construction Materials Is Increasing

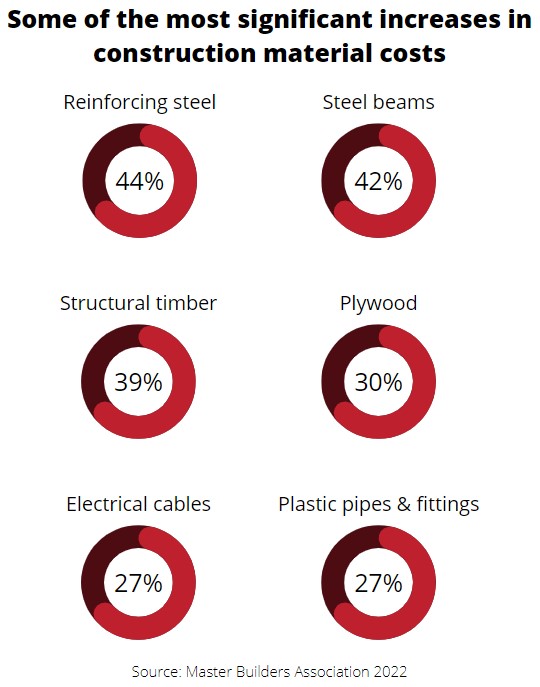

A recent report prepared by the Master Builders Association has discovered that building materials have increased 15.4% from this time last year. This is the most significant increase the market has seen since 1980!

Victorians seem to be the hardest hit by this, and the cost of building a home in Victoria is rising faster than in any other state.

There are a number of factors resulting in the increased cost of construction, such as:

- A boom in domestic and commercial construction following COVID-19 restrictions, such as Home Builder Schemes

- Situations arising globally such as the Ukraine conflict disrupting global supply and shipping

- Recent catastrophes such as bushfires and floods destroying large amounts of local timber supplies

Labour shortages and a slow reopening of the skilled migration program are also detrimentally impacting the construction industry, and contribute to the costs increasing in the industry as well.

What Does This Mean For My Body Corporate Fees?

Your strata fees go towards a number of common expenses, such as the gardening, regular maintenance of any assets, a body corporate manager and the building insurance. For most townhouses, where there are no items such as lifts, car stackers, lobbies to pay for, the majority of the body corporate fees go towards the insurance premium.

One of the factors insurers take into account when calculating an insurance premium is the cost of re-building a property. Naturally, if the cost of re-building (materials, labour etc) increase, the premium will increase accordingly.

In our experience, we have been seeing insurance premiums increase on average 15-20% from the previous year, even where there are no claims.

What Can We Do, What Options Do We Have?

The owners corporation manager unfortunately cannot control the insurance premiums insurers charge on a strata policy. However, there are a number of steps we can suggest to owners to either mitigate the increase and ensure the townhouses continue to be adequately covered.

- Insurance valuation

The insurance valuation is conducted by an external independent third party, who calculate the construction and material costs, as well as other fees including council, architects, removal of debris. As per the legislation, owners corporations with 3 or more lots need to get valuations every 5 years. To avoid the risk of underinsurance with the rapidly increasing costs of building materials, it’s recommended that body corporates obtain a new insurance valuation sooner rather than later.

- Review the insurance excess

The insurance excess is another factor insurers review when calculating the insurance premium. As a general rule, the lower the excess the higher the premium.

A lower excess means that there’s a higher likelihood of small claims being lodged, which will mean that the insurer will increase the premium next year to ‘recoup’ the losses – in the worst case scenario, they may even decline to offer renewal terms altogether! A higher excess will drastically reduce the chance of this occurring.

- Set a realistic budget

It’s normal for us to be optimistic, we like to think that the worst will never happen to us. This mindset doesn’t help us when it comes to increases in owners corporation expenses, and the setting of budgets at every annual general meeting.

We’ve seen insurance premiums increase by about 15-20% for townhouse complexes with no claims. Setting a realistic budget means that there will be sufficient funds in the body corporate bank account to pay the insurance premium, without the need for special levies or instalment payments (which incur additional costs).

- Get multiple quotes

Best practice dictates that you obtain 3 quotes for any large expenses. Why 3, you ask? If you get 2 quotes, you could have 2 distinctively different amounts and you don’t know if one is significantly underquoting or one is significantly overquoting. 3 quotes provides an accurate indication of where the average is, and allows you to make an informed decision.

With this in mind, you want to make sure your manager is doing everything they can to get 3 insurance quotes every year.

- Ensure the insurer has the correct cladding information

Though not strictly related to the increasing construction costs, this will help with decreasing the premium and/or getting multiple quotes from insurers.

If insurers don’t know the brand and type of cladding, they will always assume worst case scenario (flammable polystyrene). As a result, the quote will either be extremely high or they will refuse to provide a quote.

Insurers will often provide more competitive quotes if you have information (such as in the building plans) that confirm the brand, type and percentage of cladding used at the property.

A Summary Of Our Current Position

The total construction sector inflation will hit about 9.5% over the year to June 2022, and experts say that costs are only going to continue to increase. With these costs increasing, as well as living costs more generally, it’s important to appoint the right experts to manage your owners corporation and put you in the best position moving forward.